On January 19th, Bloomberg reported that national carrier Air India will commence large scale fuel hedging for the first time. The story was promptly picked up and reported by many leading Indian newspapers the next morning, including The Business Standard and The Mint.

As per the story, “Air India is hedging 2 million barrels of aviation turbine fuel annually at $75 per barrel” and the story goes on to state “Jet fuel in Singapore traded at $63.05 a barrel on Jan. 16, data compiled by Bloomberg showed.” Based on current aviation turbine fuel (ATF) prices $75 appears to be a price exclusive of all taxes and levies.

I am no expert in fuel hedging, in fact I admit I don’t know too much on the subject. In case my conclusions below are incorrect, I request someone with better subject knowledge to please correct me.

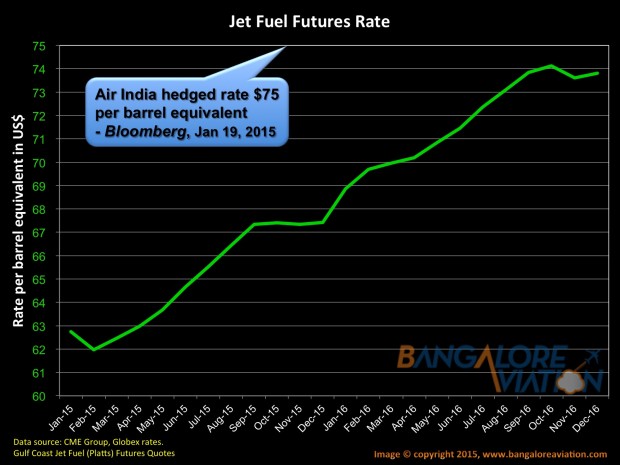

I researched the futures price of Jet Fuel (ATF) with Platts, the pricing authority which even industry body IATA uses. Graphing the futures contracts quoted for Gulf coast Jet Fuel, the price of fuel does not reach $75, the price at which Air India is hedging even by December 2016, two years away.

In fact by end of 2015 price quotes indicate a rise of just 7.4% to $67.43 compared to January’s price quotes of $62.47.

So a simple question is, why is Air India paying such a premium? I am sure there is a reason for it, but I am not able to understand it.

Please share your thoughts via a comment.

Bangalore Aviation News, Reviews, Analysis and opinions of Indian Aviation

Bangalore Aviation News, Reviews, Analysis and opinions of Indian Aviation

When airlines hedge fuel they cannot hedge it at the current market price. I think they will have to pay more than the market price because if the oil prices increase in the future then the oil companies will be at loss. Also, it depends on the amount of fuel the airline wants and for the period of time they want to hedge it.

This is according to my limited knowledge because I am still a student. Also, I might be wrong.

Fuel cost is a major operating cost for airlines and mostly it is up to 35% of the operating cost. So air India must be thinking that this one way to decrease their huge costs.

I will still discuss it with my colleagues.

Hi Devesh, you do have a valid point however it depends on how the hedge has been

carried and what all items does it cover. I have outlined the possible drivers

of this variance however it may be a case of a mix of all the below. In the

absence of details, it may be the case of something unique/different that AI

have signed up and by no means is the list below exhaustive.

1) Fuel has two moving variables, FX and Fuel price, normally

airlines try and hedge both aspects of this and hence pay more than the spot

price which drives the price to increase . This helps them against an averse

fluctuation to the FX portion of the hedge as well.

2) It could also be due to the higher state taxes in India which

are resulting in a higher overall fuel price.

3) At times, companies buy a premium hedge which allows them to

not only hedge for price increases however benefit from the fuel price falling

below the hedge price i.e. if the fuel price falls below the USD75/bbl in this

case, the company can take advantage of this.

Hopefully I have given you a bit of flavour of how fuel and

currency hedge works.

Will have to wait and see what exactly is the reason for this

price increase.

I think the price for hedging matters a lot. Singapore airlines is currently paying around $120 per barrel when the current rate is around $85. They are loosing millions and millions because of that.

If you look at delta airlines, even they were loosing lot of money because of bad hedging and they have now bought a oil refinery to reduce their costs.