In response to a series of questions from law-makers, the Indian civil aviation minister Ajit Singh and his junior minister K.C. Venugopal gave some operational insight to the Indian parliament on national carrier Air India. It was the first time, in recent memory where we obtained some numbers on the otherwise very opaque airline.

Air India debt and equity

As of December 31, 2013, Air India has an outstanding debt of Rs. 26,033 crore ($4.132 billion. Exchange rate of Rs. 63 per dollar) and its working capital loans exceeded Rs, 21,125 crore ($3.353 billion). Till January 31, 2014, the government has already pumped in equity support of Rs. 12,200 crore ($1.936 billion) out of a promised Rs. 30,231 crore ($4.8 billion) which is till 2021.

Operational and financial performance of Air India

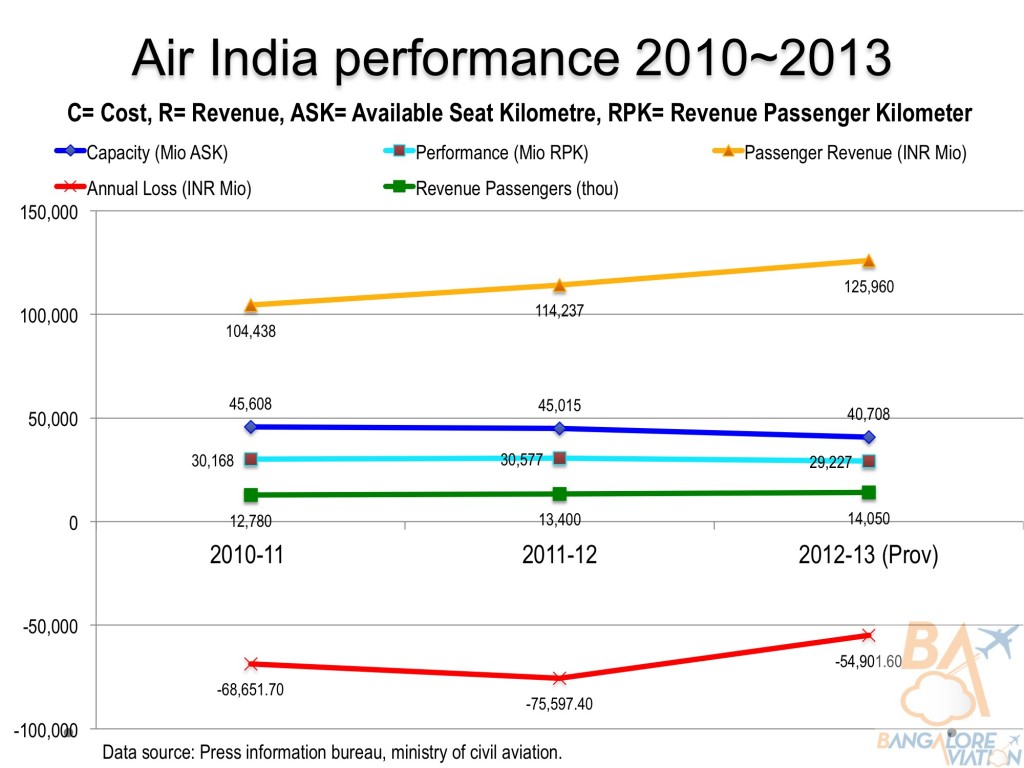

The infographic below shows the operational and financial performance of Air India for the fiscal years 2010~2011 till 2012~2013. The highlights are:

- Passenger revenue increased steadily from Rs. 10,443.82 crore in 2010-11 to Rs 11,423.69 crore in 2011-12 and to Rs 12,595.98 crore in 2012-13.

- Capacity measured in available seat kilometres was trimmed from 45,608 million ASK in 2010-11 to Rs 45,015 million in 2011-12 to 40,708 million in 2012-13 due to route rationalisation.

- Performance measured in revenue passenger kilometres also declined slightly from 30,168 million RPK in 2010-11 to Rs 30,577 million in 2011-12 to 29,227 million in 2012-13.

- The number of passengers carried increased from 12.78 million in 2010-11 to Rs 13.4 million in 2011-12 to 14.05 million in 2012-13.

- Losses continued to pile up. From Rs. -6,865.71 in 2010-11 to a nadir of Rs -7,559.74 crore in 2011-12 and improving, if one could call that, to -Rs 5,490.16 crore in 2012-13.

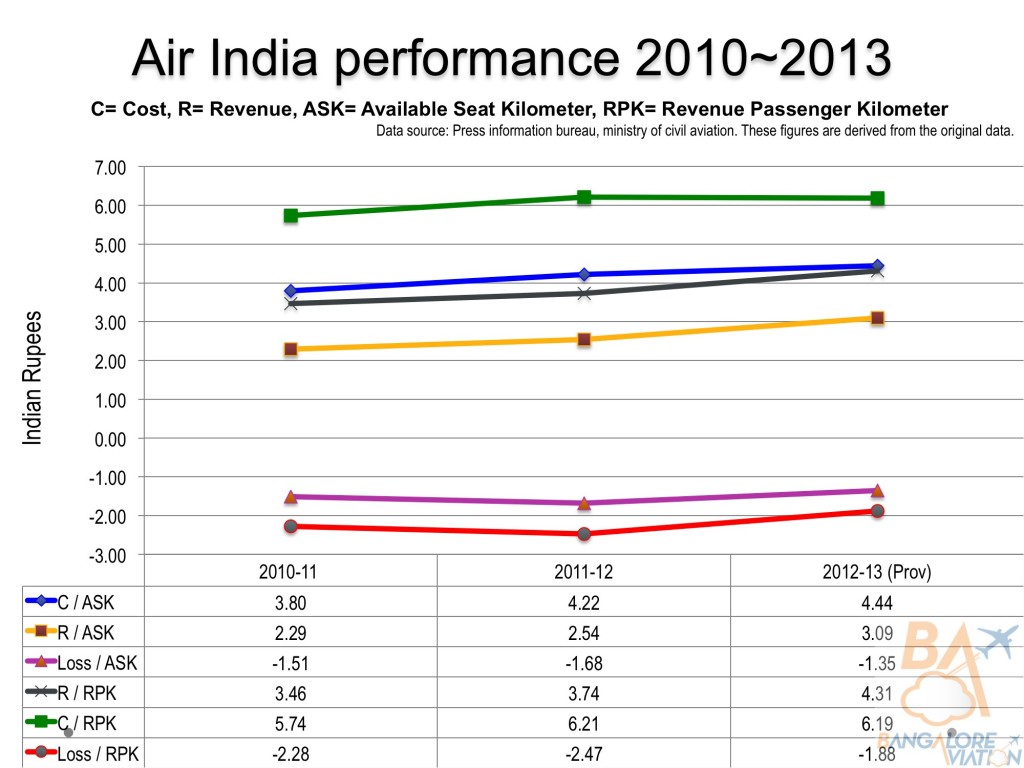

Operational metrics

Based on the above data, for the first time, we have been able to derive crucial operational metrics of Air India. These include cost per available seat kilometre (CASK) and revenue per revenue passenger kilometre (RRPK). It is clear to see, while Air India has similar RRPKs to other full service private carriers, its costs are way out of control leading to the humongous losses the airline is suffering.

Operational metrics comparison Air India to Jet Airways

Compared to the other full service carrier, Jet Airways, Air India has better revenue numbers per passenger, reflective of the longer routes flown by the national carrier. It even earns similar revenue per revenue passenger kilometre flown. However, all comparisons end there. Air India has significantly poorer load factors, its cost per available seat kilometre is almost 30% higher than Jet Airways, and consequently bigger loses.

|

Passenger load factor |

Avg Revenue per pax (INR) |

Avg Loss / Profit per pax (INR) |

Cost per ASK (INR) |

Revenue per RPK (INR) |

||||||

|

AI |

Jet |

AI |

Jet |

AI |

Jet |

AI |

Jet |

AI |

Jet |

|

|

2010~11 |

66% |

80% |

8,172 |

7,207 |

-5,372 |

6.61 |

3.80 |

2.91 |

3.46 |

3.64 |

|

2011~12 |

68% |

89% |

8,525 |

7,271 |

-5,642 |

-714 |

4.22 |

3.45 |

3.74 |

3.86 |

|

2012~13 |

72% |

84% |

8,965 |

8,499 |

-3,908 |

-288 |

4.44 |

3.89 |

4.31 |

4.64 |

*Air India numbers for 2012~13 are provisional.

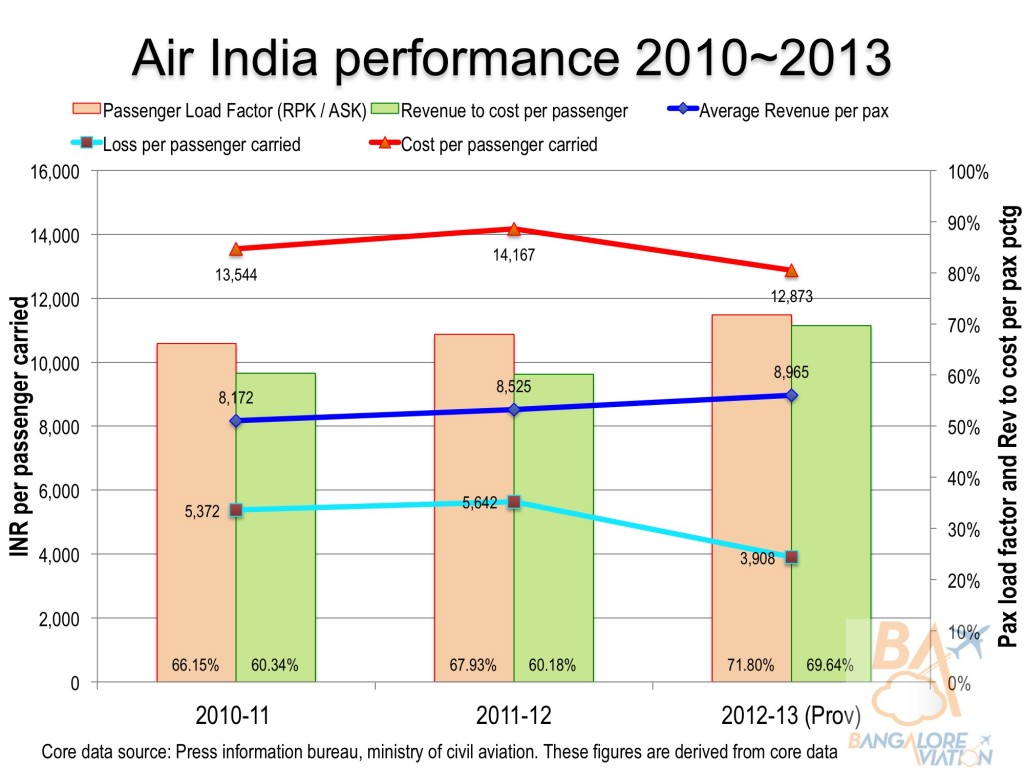

Shocking numbers

Air India has shown some improvement in its average revenue per passenger from Rs. 8,172 in 2010~11 to Rs. 8,525 in 2011~12 and Rs. 8,965 in 2012~13. However, its costs per passenger carried are still way above its revenue; from Rs. 13,544 in 2010~11 to Rs. 14,167 in 2011~12 though there has been some reduction to Rs. 12,873 in 2012~13. The passenger load factors too have improved from 66.15% to 67.93% to 71.8%.

Astoundingly, Air India still continues to lose almost Rs. 4,000 for each passenger it carries, which is a full 30.5% of its costs, though this is a significant improvement, if you want to call it that, from 2011~12 when the airline lost Rs. 5,642 per passenger, almost 40% of its cost.

Conclusion

Despite improvements over the last 18 months, Air India is still performing in a terrible manner compared to any other privately operated carrier in India. Despite direct bail-outs, and indirect support like long credit terms by government owned airports and oil suppliers, forcing of government travel exclusively on Air India, and sovereign guarantees on loans to enable low cost financing, the airline continues to languish.

The improvements apparently demonstrated in 2012~13 are a mirage. Passenger load factors have improved due to the demise of Kingfisher Airlines and the shifting of full service passengers to Air India and Jet Airways. The entry of the yet to be named Tata-SIA full service carrier will put pressure on both the incumbents but on Air India more. The costs, primarily driven by its over-bloated work force are out of control. In classic political moves the airline has tried to brush the dirt under the carpet by transferring the engineering and ground handling staff in to separate companies. While this shows a reduction in costs on the books of Air India, it is merely shifting the costs to other companies, and ultimately this is only delaying the inevitable.

There is no way the airline can be revived while under the operational control of the government, and as loans and debts take on monstrous proportions, hopes of any private player taking over the carrier are almost extinguished along with the value proposition for the airline.

Do share your thoughts on the airline and the analysis.

Bangalore Aviation News, Reviews, Analysis and opinions of Indian Aviation

Bangalore Aviation News, Reviews, Analysis and opinions of Indian Aviation

My first reaction to this article was – “Wow, so finally we have some numbers from Air India that can be analyzed”. So what is very clear is that although load factors are improving the financial health of the airline is not. So all the trumpeting by AI so far that its performance is improving, without having provided concrete numbers is misleading.

Its ‘SHOCKING’ to hear that on average AI loses 4000.00 for every passenger. Common sense tells that three things are killing AI – a bloated workforce, operational in-efficiency and political interference. Unless all these three things are fixed, no amount of bail outs and credits will help.

great analysis. the numbers of revenue and cost are self explanatory. the last chart shows what can a private airline can do and what a bloated work force with slow moving govt officers can do. kudos

So many factual inaccuracies and holes in this blog-post that i dont know where to start!

Govt employees forced to fly full-fare? Really?

This unfortunately is the state of aviation writing in this country: hatchet jobs and rants, sometimes by lobbyists working for rival airlines, posing as informed “journalism”.

Roy, we pride ourselves on our accuracy. After reading your comment and conducting my due diligence we have removed the reference of full fare. Thanks for helping us improve our accuracy.

On the flip side, if you finding “so many factual errors”, please point them out and help us correct them.

Now coming back to full fare. Let me point out an example. Air India introduced a Companion Free Scheme (CFS) where if the main ticket is bought at full fare business class, a companion can fly free. In this scheme, if the normal discounted business class on AI Delhi to New York is at Rs. 1,80,000 which also similar to the fares offered by other airlines, the CFS scheme required the main ticket to be bought at full fare i.e. Rs. 3,60,000. So in reality there is no saving. This scheme was introduced for the bureaucrats and PSU management who would charge the full fare ticket to the government or again to the government via the PSU, and take their wives for free. Is this not a form of subsidy to the airline? i.e. giving them two seats instead of one?

As far as lobbying goes, I have only one agenda, saving my tax money from being wasted in bailing out Air India. I love the airline, am a member of their frequent flier program and want the ugly paws of the government off the airline.

I do not get paid for any article. BangaloreAviation is a labour of love, and I am renowned globally for my independent views which believes in calling a spade a spade.

I look forward to your positive contributions to our site.

@cougarrides:disqus, I took a minute to look through your previous comments on disqus, all you seem to know how to do is whine about something or the other.

If you know so much, please take some effort and post your own blog. But on the other hand you really do come across as a bit of a nut who has nothing better to do than try to flaunt your completely wrong knowledge.

People like you are the reason the government can get away with alot of it’s nonsense because there are enough gullible people like you to believe all their propaganda and spew it as the obvious truth.

Next time just think of what I just said before you start tying to spew some more rubbish.

Let us please keep the comments civil. Avoid becoming personal please. Thanks in advance.

Air India International schedules are just lost focus on what they want to achieve. Some officials based in Delhi seem to promote Delhi as hub while others push more international flights to other destinations. Australia schedules are just flying with minimum loads barely sufficient for covering costs. Now I am hoping that they at least connect the upcoming Moscow flight to Australia route. Meaningful connection would be night flight to Moscow.